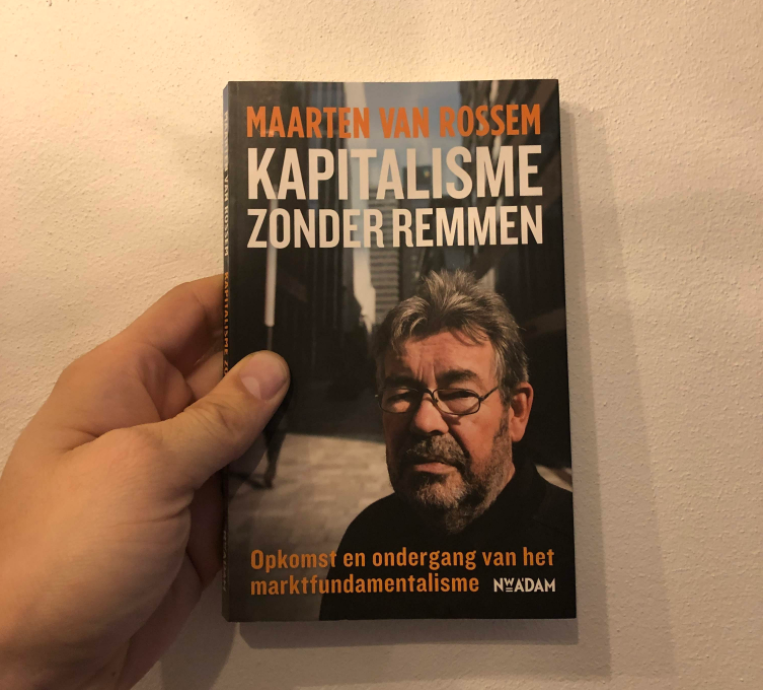

In his highly distinctive ‘tone of voice’, Maarten van Rossem provides the most succinct available lecture on the root causes which lead to the 2008 financial crisis.

From the change in Keynes thinking (after the 1920s) to the Hayek and Friedman ideology — embodied by the neoliberal policies of Reagan and Thatcher. Van Rossem explains how culture and ideology shifted and, combined with technology and humanity’s never-ending greed, provided the perfect ingredients for what happened in 2008. And what will probably happen again; because humans never tend to learn.

Van Rossem doesn’t wait for the reader, he uses very direct, compelling argumentation, but provides few footnotes or sources. So it’s a matter of believing what the messenger says, as opposed to the messenger providing evidence for his claims. But when you do, this book is the most tight high-level historical overview of the 2008 financial crisis you can find.

Side note: I found it remarkable that van Rossem (as a historian) shares similar ideas with Nassim Nicholas Taleb (who tends to dislike what historians do). E.g. they both subscribe to the idea of people’s general misinterpretation of the Gaussian distribution (the Bell curve). And they both share their admiration for Kahneman and they both seem to dislike the Nobel prize.

Leave a Reply